Many Australians don’t have to think twice about saving for retirement because their employer regularly contributes on their behalf. These savings then have decades to grow and years to ride out the ups and downs of the share market.

But what happens once you retire? Is there a one-size-fits all, no fuss retirement investment option? Right now there’s not, so it’s important to understand what you need to start thinking about to make the most of your retirement savings. Brian Long explains.

Why investing for retirement is so different to saving for retirement

When you’re saving for retirement, you’re in the accumulation phase. You’ll generally want a portfolio that has the potential to grow your money over the long term. Because you’re regularly adding to the portfolio with super guarantee contributions, and you’re not taking money out, you can tolerate investment fluctuations expecting your funds to recover over the longer term.

In retirement however, your attitude and investment goals will change. People typically become much more risk averse because their focus will shift to preserving what they’ve saved and generating an income.

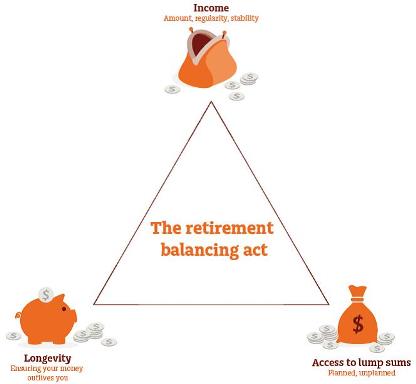

When you’re thinking about investing your retirement funds, there are three important factors you need to plan for:

-

Generating an income for day-to-day living;

-

Having access to lump sums for one-off events like holidays or a new car; and

-

Longevity – ensuring your money will last your entire retirement.

These are shown in chart 1.

Chart 1: Balancing the demands for your retirement funds

Source: NAB Asset Mangement.

Deciding how to invest for retirement is no mean feat and every retiree is likely to have a different view on the relative importance of each of these goals.

An obvious challenge in planning for your retirement is that it needs to be done without knowing how long retirement will actually be. And, without knowing the time horizon, it’s very difficult to know whether your spending can be higher or needs to be lower, and on the other side of the coin, whether your investments should be conservatively or more aggressively managed to make the most of what you’ve saved.

What risks do you need to think about in retirement portfolios?

In accumulation, your biggest concern is usually market risk: the impact of market fluctuations on the value of your investments.

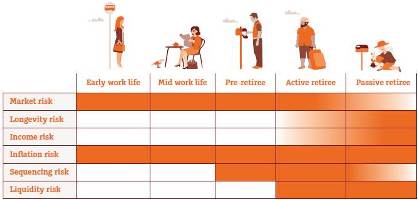

As a retiree you’ll live off your savings, so you do need to be concerned about market risk, but you’re also exposed to other investment risks. These are important to understand when you’re planning for your retirement:

-

Longevity risk – the risk of outliving your savings

-

Income risk – your spending patterns will change over the life of your retirement. This is the risk that your income won’t be able to keep up with your spending

-

Inflation risk – the risk that price rises (such as electricity costs) erode the purchasing power of your retirement savings

-

Sequencing risk – the risk of significant negative returns depleting your capital just before or early in retirement

-

Liquidity risk – the risk of not having ready access to your money when it’s needed, especially for health shocks and aged care (without losing potentially some of your capital or incurring penalties).

The importance of these risks also changes during retirement. For example, while sequencing risk is very important early in retirement, longevity, liquidity and inflation risk become more important considerations over time. See chart 2.

Chart 2: Different risks impacting your retirement savings over your lifetime

Why you can’t ignore sequencing risk

The possibility of a major market downturn just before or at retirement is of particular concern to new retirees and pre retirees. As well as impacting the value of your retirement savings, you may need to regularly withdraw from your savings to generate retirement ‘income’. Because you may have to do this at the bottom of the market, you’re further reducing your retirement pool. When markets do eventually recover, you’re coming off a reduced capital base and it’s harder to recoup losses. This sequence of events and returns could significantly impact the value of your investments and create a shortfall in how long your savings will last. It’s very important to plan for this kind of risk, as best you can.

Starting to put together a retirement strategy

Having a strategy is important and investing in a variety of funds can help address different needs and risk. Here are some pointers to help you begin your planning:

-

How much income will you need? The ASFA Retirement Standards are a good starting point

-

Income generation: consider bonds and dividend-focused funds. They aim to deliver a reliable income stream to provide for day-to-day expenses and have the potential to grow

-

Tackling inflation and growth: consider funds that specifically target returns above inflation. These funds should also grow your savings over the longer term

-

Cash: when you need income or to access lump sums, it’s good to have funds in cash, so you don’t crystallise short-term market losses that may occur.

By Brian Long, Head of Retirement

Important information

This information has been provided by MLC Investments Limited (MLCI) (ABN 30 002 641 661, AFSL 230705), a member of the group of companies comprised National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686), its related companies, associated entities and any officer, employee, agent, adviser or contractor (‘NAB Group’). An investment in any financial product referred to in this communication is not a deposit with or liability of, and is not guaranteed by the NAB Group.

This information may constitute general advice. It has been prepared without taking account of individual an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.