Australian investors may be well-aware of the basic diversification benefits of global equity investing relative to domestic investing, but franking credits tend to win the day and keep home country bias firmly entrenched in portfolios.

There is however, more to the story than is usually understood. It’s worth looking deeper into the risks associated with a portfolio dominated by Australian equities, and the benefits a global opportunity set can provide when constructing investment portfolios.

Looking back

While past returns shouldn’t be the only consideration when deciding whether to invest in Australian or global equities, some investors may want to know if there has been much of a return difference.

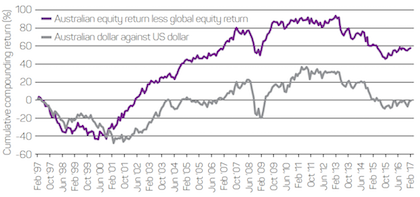

As shown in Chart 1, over the past 20 years Australian equities have done considerably better than global equities. In fact, they performed over 50% better on a cumulative return basis, which equates to about 3% greater returns per annum. However, over the past 10 years, there was much less difference. Australian equities returned 4.3% pa, whereas global equities returned 4.6% pa.1

Chart 1: Return difference of Australian Equities and Global Equities

Chart 1 compares the return difference between Australian equities, referencing the S&P/ASX 200 Accumulation Index, and global equities (unhedged), referencing MSCI World ex-Australia Total Return Index in Australian dollars. This return data was calculated on a cumulative return basis over the past 20 years.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Source: Calculations by Altrinsic Global Advisors, and data sourced from Bloomberg, as at 28 February 2017.

The China factor

Why is this? During the first 10 years of this returns comparison, which accounts for the entire 20-year outperformance, the Australian economy was heavily influenced by urbanisation in China, which was beneficial for many sectors and companies within the Australian stock market, especially materials. This was a truly golden period for Australia and one that is unlikely to be repeated in the foreseeable future. Although resource demand from China will continue, it is no longer from a low base and will have considerably less potency than it did in the early part of the twenty-first century, especially as China continues to transition from an investment-led to a consumer-driven economy.

Currency risk

Investing in global equities does introduce an additional risk which is not applicable when investing purely in Australian equities; and that is currency risk. In the short term, currency risk can materially impact unhedged global equity returns, however in the long term, currency risk can aid diversification and have a lower impact on global equity returns. The Australian dollar (relative to the US dollar) has had a limited impact on return outcomes over the past 20 years, although Chart 1 does show two distinct 10-year cycles.

Two elements that have influenced the Australian dollar over the last 20 years are:

-

the balance of trade benefits from inflated resource prices given the demand from China (in the first 10 years or so); and

-

real interest rate differentials, which supported the Australian dollar until mid-2011.

At its peak, the real interest rate differential with the United States was 0.43% per month, but now it has fallen to just 0.07% per month.2 This declining real interest rate differential and weaker demand for resources was a considerable tailwind for unhedged global equity returns over the past five years, as the Australian dollar depreciated.

Despite these strong cyclical pressures, the Australian dollar has had a limited impact on returns from global equities over the past 20 year period.

Divide the risk and conquer opportunities

The key to managing your investments is to adequately understand the risks you are taking and have deliberate investment strategies that avoid unwanted risks and capture favourable opportunities. The two key sector exposures in Australian equities, materials and banks, are cyclical in nature. This means there are periods of time when it makes sense to hold more or less of them, and that’s where global equities play an important diversification role.

The sector concentration in the Australian market leads to a greater exposure to systematic or market risk, making it harder to express company specific risk (ie stock specific risk) in investment portfolios. The benefit of company specific risk is that it drives diversification and enables active investment managers to invest with conviction in companies that will differentiate their returns from the market and other managers. Portfolios can be constructed to reflect a combination of ideas that are both specific in nature (and tied to a company’s performance) and uncorrelated with one another. This approach can lead to greater outperformance of the market, particularly when market valuations are elevated. In a global context, the ability to use this approach and find attractive, bottom-up, risk-adjusted investment ideas is significant given the magnitude of company-specific circumstances across multiple sectors and countries around the world.

Although exposure to market risk is hard to avoid, investing globally instead of purely domestically provides both market diversification as well as the broadest company-specific opportunity set in the hunt for superior returns.

The other element of global investing is, of course, capturing opportunities from a much larger pool of companies. This has always been the traditional argument since the Australian market makes up only 2.7% of the global investment universe.3

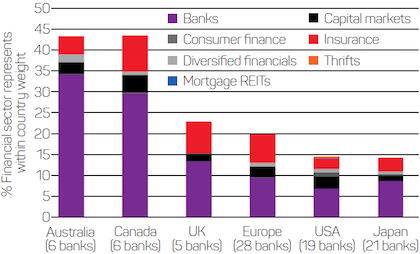

Chart 2: Financial sector weight at the country level and sub-industry components

Source: MSCI World Index, FactSet and Altrinsic, as at 28 February 2017.

The financial sector – a diversification example

The financial sector in Australia makes up 38.4% of the index (as measured by the S&P/ASX 200 Index), whereas the financial sector globally makes up 17.9% (as measured by MSCI World Index).4 However, it is not just the concentration differences that aid diversification, it is also the pure opportunity set at the company-specific level.

Financial companies are somewhat tied to their home macroeconomic circumstances as well as the competitive dynamics at play, and this provides an important backdrop when considering this sector. Financial companies have heightened sector risk, and therefore competitive dynamics need to be relatively favourable and valuations must be supportive to adequately compensate for their risks. This is particularly so for banks, which make up a disproportionately high proportion of Australia’s financial sector.

Using MSCI World Index weights, Chart 2 shows the financial sector weights by different countries/regions, as well as the sub-industries that make up the financial sector. For example, the financial sector makes up 43% of the Australian country weight in this index and banks make up 34% (or 80% of the financial sector weight). Consider this in the context of Australia’s 2.7% weighting in the MSCI World Index.3

Canada is similar in structure to Australia, but once you move into the larger markets the diversification benefits are more obvious.

Given the risks mentioned above, a global opportunity set is attractive, particularly for a bottom-up, benchmark-unaware manager. If certain markets exhibit unfavourable competitive dynamics, such as an irrational oligopoly or local regulatory policies that overly restrict growth opportunities, they can be avoided altogether. In addition, a global opportunity set allows better diversification across different business models within the financial sector. For example, one can limit balance sheet risk but still maintain a significant weighting to financials in a portfolio by investing in cash-flow-driven financials like insurance brokers and stock/derivative exchanges. A broader country opportunity set simply provides the ability to find circumstances where the local market competitive situation might fuel growth drivers unavailable in Australia.

This example demonstrates the concentration risks in Australia as well as the global diversification benefits within the financial sector. Of course, this can be applied to multiple sectors and all countries, thereby offering a vast opportunity set.

Investors may look at the last 20 years of Australian share market outperformance and use that to guide their decision about whether to invest globally. However, taking a closer look at the drivers of these historical returns and revisiting the traditional arguments of diversification provides solid investment rationale for reviewing home country bias in your portfolio. Release the shackles and optimise the potential risk-reward equation by going global.

If you would like to discuss anything in this article, please call us on (08) 8723 9822.

1. Bloomberg, data measured between 28 February 2007 – 28 February 2017. Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

2. Bloomberg, as at 28 February 2017.

3. Based on MSCI World Index, FactSet and Altrinsic as at 28 February 2017.

4. Based on S&P/ASX 200 Index and MSCI World Index as at 28 February 2017.

Important information

This publication is provided by Antares Capital Partners Limited (ABN 85 066 081 114, AFSL 234483) (ACP) a member of the group of companies comprised National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686), its related companies, associated entities and any officer, employee, agent, adviser or contractor therefore (‘NAB Group’). Any references to “we” include members of the NAB Group. An investment in any product or service referred to in this publication does not represent a deposit or liability of, and is not guaranteed by NAB or any other member of the NAB Group.

This information may constitute general advice. It has been prepared without taking account your objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Any projection or other forward looking statement in this publication is provided for information purposes only. No representation is made as to the accuracy of any such projection or that it will be met. Actual events may vary materially.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

This information is directed to and prepared for Australian residents only.

The funds referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such fund.