27 March 2018

Bob Cunneen, Senior Economist and Portfolio Specialist, NAB Asset Management

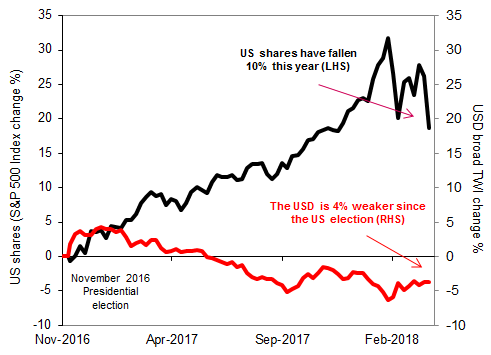

US asset prices since President Trump’s election

Source: US Federal Reserve, St Louis

President Trump’s election in November 2016 had been a magic elixir for Wall Street. The ‘Trump trade’, cutting the corporate tax rate from 35% to 21%, saw US shares initially surge by more than 30% (black line) to peak in January 2018, as measured by the S&P 500 Index.

However the US dollar was more sceptical on this ‘Trump trade’? The USD has been falling since early 2017 and is now -4% below the level of November 2016 (red line). This is partly due to better economic data in global markets and also lingering concerns over President Trump’s protectionist rhetoric with “America first”.

Wall Street is now realising the threat posed by President Trump’s ‘trade war’ agenda with a sharp 10% fall in US share prices since January’s peak. The proposed tariffs on steel, aluminium and selective imports from China could damage corporate profits as well as the global trading system. Higher US inflation from rising imports prices could also accelerate the pace of interest rate increases by the US central bank.

While President Trump has promised that “trade wars are good and easy to win”, Wall Street is now considering these trade wars as likely to cause painful and prolonged economic conflicts.

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis