It’s often been mentioned that $1 million or more in superannuation savings is needed to live a comfortable retirement. This is a daunting figure for most of us and, unsurprisingly, has many Australians concerned about the kind of retirement lifestyle they have to look forward to.

In reality, most Australian workers have nothing like this in super, and yet pleasingly, still report being satisfied and fulfilled in retirement. In December 2015, the Association of Superannuation Funds of Australia (ASFA) published that average super balances at retirement were $292,500 for men and $138,150 for women; and for households $355,000. Far less than $1 million.1

So how much do you actually need and can relatively modest balances make a meaningful contribution to an adequate retirement income?

How much do I really need?

When thinking about retirement, we don’t tend to think about our super balance. Instead, we think about a lifestyle we want in retirement and translate this into how much cash we will need per week, month or year to live this lifestyle.

A good place to start is to think about the amount of money that we typically spend and break this down into essential needs (such as food, clothing, utilities), preferences (such as holidays, travel, eating out frequently) and nice to haves (such as a boat or holiday home). Thankfully we can take out work related expenses and hopefully children’s education costs.

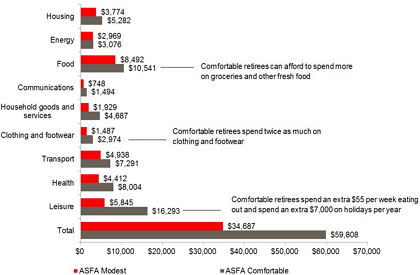

As a rough guide, ASFA has taken into consideration these potential living expenses, excluding rental costs and calculated two retirement categories of ‘Comfortable’ and ‘Modest’. While your individual circumstances and needs may differ considerably it helps to put into perspective the overly-alarming $1 million figure. Tables 1 and 2 below show the ASFA guidelines.

Table 1: The amount of savings needed to support a modest or comfortable retirement for retirees aged 65 – 85.

|

Category |

Savings required at retirement |

Annual spending in retirement |

|

Comfortable lifestyle for a couple |

$640,000 per couple |

$59,808 per couple

|

|

Comfortable lifestyle for a single person |

$545,000 |

$43,538

|

|

Modest lifestyle for a couple (aged 65-85) |

$35,000 per couple |

$34,687 per couple

|

|

Modest lifestyle for a single person (aged 65-85) |

$50,000 |

$24,108

|

Source: ASFA Retirement Standard – December Quarter 2016. All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent. They are based on the current means test for the Age Pension in effect from 1 January 2017.

Table 2 shows the differences between what people spend in a modest and a comfortable retirement, as calculated by ASFA.

What is the difference between a modest and comfortable lifestyle?

Source: ASFA Retirement Standard – Detailed Budget Breakdowns – December Quarter 2016.

Don’t forget the Age Pension

So how can a single person retire with only $35,000 in super and still spend the “modest” $34,687 a year? Currently the Age Pension makes this possible and is sometimes overlooked by people when thinking about how much they need to retire. This is why the lump sums needed for a modest lifestyle are relatively low as the Age Pension is sufficient to meet most expenditure needs. Currently the full annual Age Pension is approx. $22,700 for an individual and $34,250 for a couple. As you can see, if you include the Age Pension in your calculations, the lump sums needed for a modest lifestyle become much less daunting.

For example, if each person in a couple has $100,000 in super, that could generate ~$11,000 each year for 20 years2 or so. For those who meet the eligibility requirements of the age pension, these additional payments could help move a couple from a modest lifestyle nearly halfway towards a comfortable lifestyle according to the ASFA Retirement Standard.

So what can I do to improve my retirement?

While the Age Pension is one consideration to take into account, here are some other things you could think about to help you to a better retirement:

-

Remember, small amounts of super go a long way. For example a super retirement balance of $150,000 delivers a weekly income of $163 per week over and above the Age Pension. That’s 38% more than you would get if you relied solely on the Age Pension.

-

Can you increase your super contributions as much as possible when working? Generally, salary sacrificing superannuation, by making before-tax super contributions, is a popular strategy. Don’t forget to check that you don’t go over the contribution caps for superannuation.

-

Your assets outside super – this will give you a clearer picture on your eligibility for the Age Pension through the Assets Test. And keep in mind that the Age Pension eligibility rules and payment amounts are controlled by the Federal Government. Try to avoid the temptation to take a large lump sum super payment and instead remain invested. It is intuitive that regular savings and growth in investment returns are important to building a retirement nest egg. What is less appreciated is the importance of investment returns post retirement, which can produce more than half of your retirement income during your retirement.3

-

Consider part time work – recent research shows that an increasing number of people want to keep working after they reach retirement age (23% intend to work beyond 70 years).4 While this income helps provide financial security, many state it also provides personal satisfaction.

What can I do now?

So do you need $1 million in retirement? Not necessarily, it depends on your lifestyle goals and your assets outside of super. We can help you review your expectations of retirement and build this into your retirement plan, whether retirement is years away or around the corner. Call today on (08) 8723 9822.

1. Superannuation account balances by age and gender, ASFA. 2015

2. Calculations via the Challenger Retirement Illustrator calculator, March 2017. Average Returns are determined by calculating the average of 2000market simulations provided by Willis Towers Watson. The simulation is based upon average market scenario returns (before fees) as follows: Asset allocation 50/50 growth defensive split. Defensive return 3.7%pa; Growth return 2.5% pa capital and 5.2% pa income Growth. Age Pension based on laws current at 20 March 2017 and increase with CPI. Amounts are shown in today’s dollars. Total asset based fees are 1.30% for growth and 1.1% for defensive assets.

3. The Russell 10/30/60 Retirement Rule. Russell Investments. July 2015.

4. Retirement and Retirement Intentions, Australia, July 2014 to June 2015. ABS. March 2016.

Important Information

This information has been provided by MLC Investments Limited (MLCI) (ABN 30 002 641 661, AFSL 230705), a member of the group of companies comprised National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686), its related companies, associated entities and any officer, employee, agent, adviser or contractor therefore (‘NAB Group’). Any references to “we” include members of the NAB Group. An investment with MLCI does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. This information may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. While MLCI has taken all reasonable care in producing this communication, subsequent changes in circumstances may occur and impact on its accuracy. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication. Any projection or other forward looking statement (‘Projection’) in this document is provided for information purposes only. No representation is made as to the accuracy of any such Projection or that it will be met. Actual events may vary materially. MLCI relies on third parties to provide certain information and is not responsible for its accuracy. MLCI is not liable for any loss arising from any person relying on information provided by third parties.